The best European countries for digital nomads

The idea of working from foreign lands with nothing more than a laptop and an internet connection has largely been considered something reserved for young freelancers.

But not anymore.

The rise of remote working has revolutionised the idea of working abroad while being employed by a company in the employee's home country.

And many nations are taking advantage of the creation of new digital nomad visas, which allow foreign nationals to live and potentially take up residency in a new country while remaining employed.

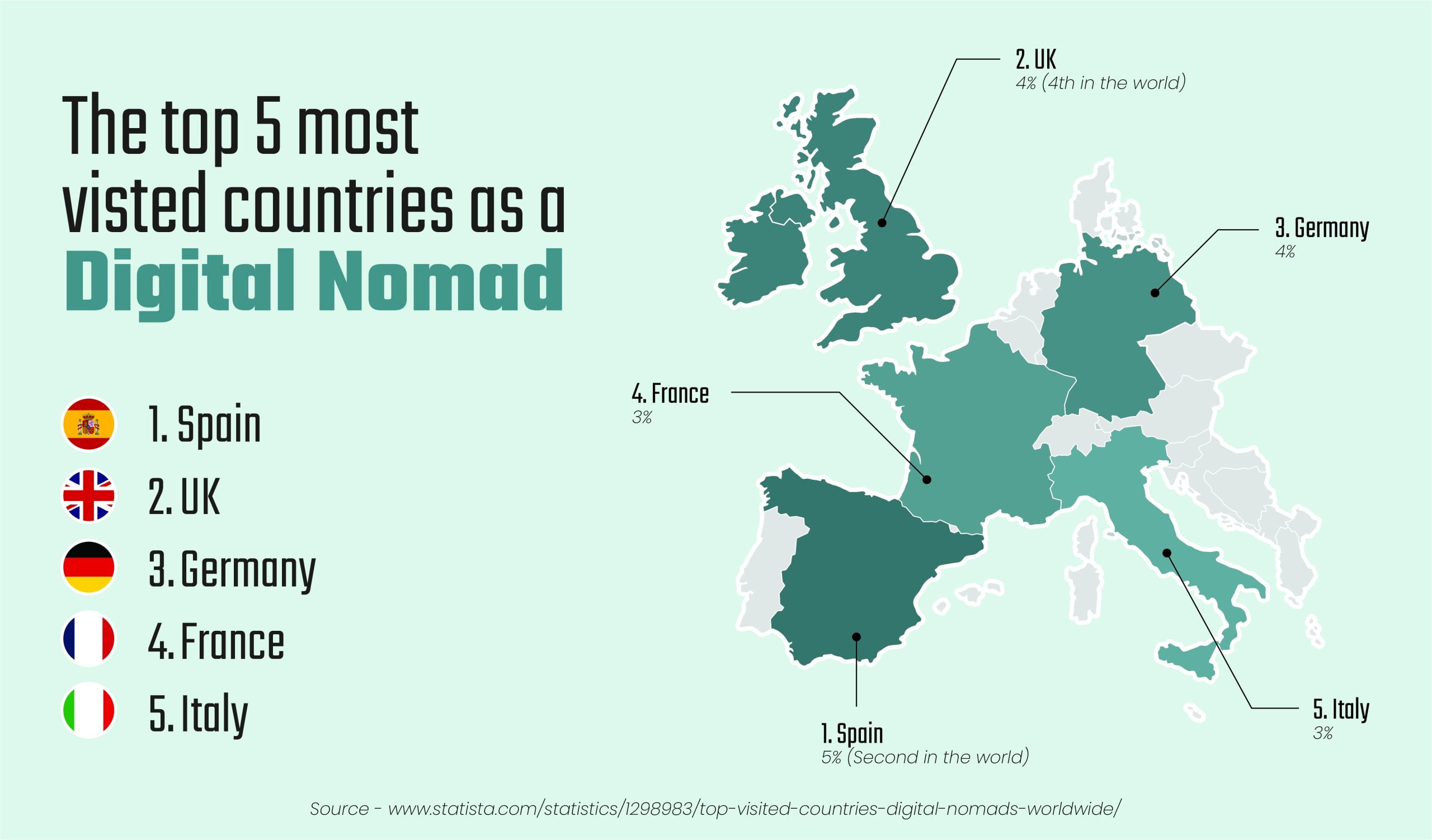

Within Europe, many countries have already been taking advantage of this for a few years, but now some of the EU’s major economies - including Spain - have developed their own digital nomad visas.

But when you’re looking to take your career abroad, where is the best place in Europe to go?

Below are the top European countries for remote workers based on the most important criteria for digital nomads, including:

- Favourable visa entry requirements (based on earnings)

- Cost of living

- Internet speed and infrastructure

- Climate

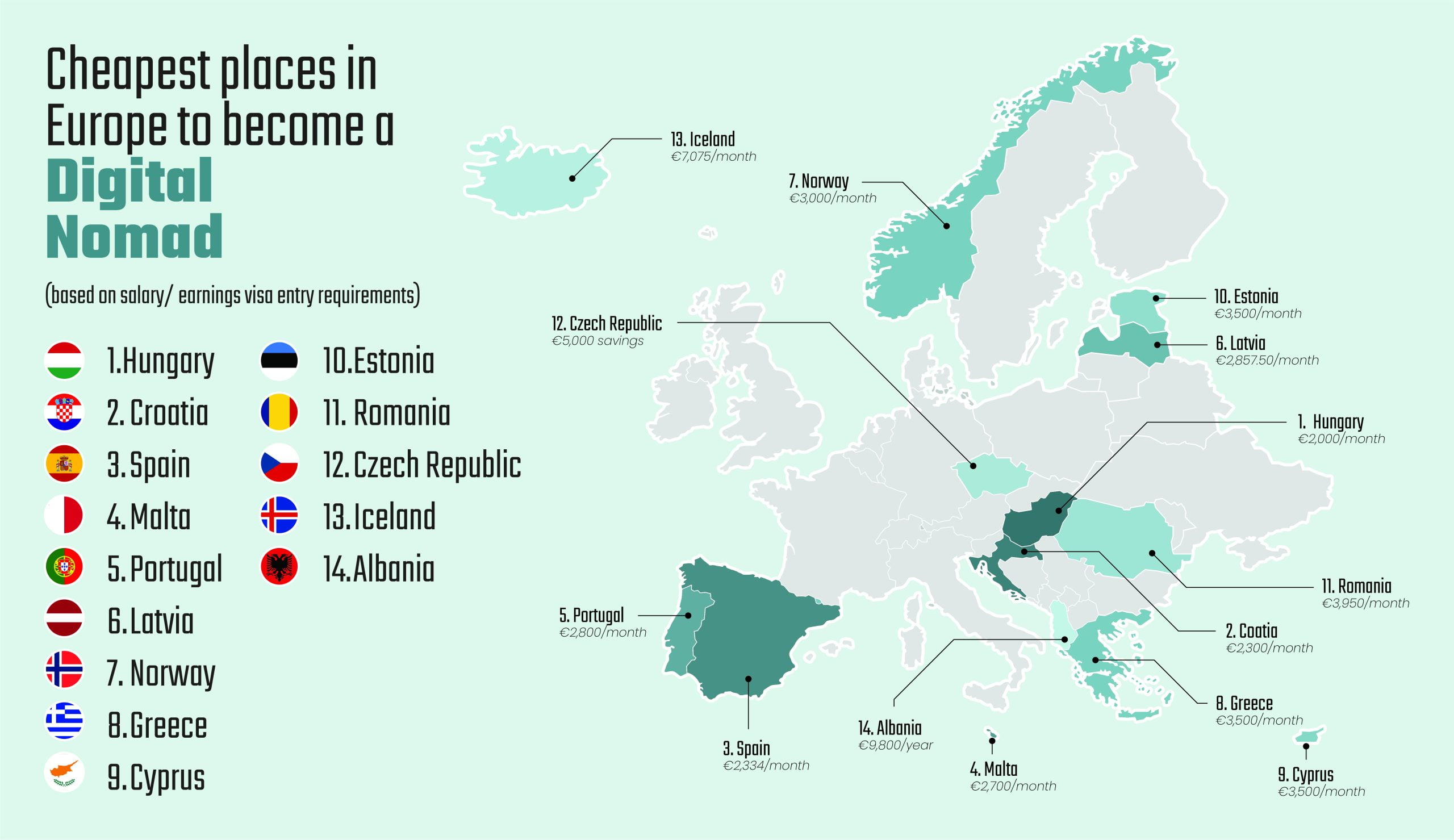

Lowest income requirements to become a digital nomad

- Hungary

- Croatia

- Spain

- Malta

- Portugal

- Latvia

- Norway

- Greece

- Cyprus

- Estonia: For digital-forward infrastructure on a budget

At €2,000 a month, Hungary has the lowest entry requirements for digital nomads when it comes to salary and earnings.

Unlike other digital nomad visas, Hungary doesn’t allow you to bring your family with you, so as long as you’re travelling solo you’ll be fine. And with a monthly cost of living at around $860 a month (including rent)

If you’re single, you could easily manage to live here on the minimum salary requirements, with the cost of living coming in at around $860 a month (including rent).

If you’re planning on moving with a family, you’d need a higher salary or dual income, with the cost of living for a family of 4 coming in at around $2,200.

One thing to consider here is the visa length. Initially starting at one year, there is a possibility to extend your stay by one-year maximum. Up to now there are no details over whether you can apply for a permanent visa after a certain period.

Another benefit of the Hungary digital nomad visa is the short-term tax incentives. You’ll be considered a tax resident in Hungary only when you live there for at least 183 days, so you’ll only pay tax in Hungary after you’ve exceeded that time.

At €110, the application fee for the Hungary digital nomad visa is among the more expensive.

On the face of it, the Croatia digital nomad visa (although it’s really a residence permit) is a good option. To be eligible for the permit, you need a monthly salary of around €2,300 a month. More than double the average after-tax monthly salary of native workers.

This amount increases by 10% for any additional family members or partners who will be joining you.

If you’re single, you’ll have no problem living a comfortable life, with the average cost of living for one person sitting around €950. Even with a family of four, you’d be just above the cost of living threshold of €2196.

And at €60, the visa application fee is among the lowest.

However, digging into the details shows that the Croatian digital nomad visa is quite restrictive as it’s only open to those in the “communication technology” sector.

The initial one-year visa with the possibility to renew is pretty standard among nomad visas.

Spain’s digital nomad visa is one of the most anticipated visas with the country already hugely popular with retirees from the UK and around the world.

With an income requirement of €2,334, Spain is in the top 3 cheapest places to move as a digital nomad based on income. With the native monthly salary after tax around €1,650, you’d be well above the average wage brackets as a digital nomad visa holder.

And with the average cost of living for a single person being around €1,144 you’d be more than comfortable with a single wage, even in some of Spain’s more expensive areas.

Perhaps one of the most appealing parts of the Spanish digital nomad visa is the tax breaks available.

Provided you earn below €600,000 a year, you’ll only pay 15% tax during your first four years instead of the usual 24%.

Spain also provides another benefit when it comes to visa length. After an initial one year, you can renew annually up to five years, at which point you can look into options to get a resident permit and everything that comes with it.

And all this is before you look at the reliably sunny weather and preferable climate, which is what makes Spain such a desired destination for holidayers and retirees already.

Plus, a recent OECD report put Spain’s economy at the top of the pile regarding growth over the next few years, meaning it’s an ideal place for workers.

Leaving the top 3 lowest income requirement countries, we’re starting to see other digital nomad visas that would be in the grasp of only higher earners.

While not completely out of reach at €2,700 a month, the salary requirements for digital nomad visas puts holders in a wage bracket more than double the monthly salary - after tax - of native workers.

With the cost of living for one person around €1,230 you’d have no problem living comfortably based on the requirement salary.

The application fee for a visa is also among the highest at €300 and the current visa length is one year with no details available over whether you can renew after the initial period.

Portugal has long held a reputation for enticing foreigners to take up residency.

It’s D7 visa, which is aimed at retirees and those with passive income to settle in the country with the opportunity to gain residency after a certain number of years is one of the most popular “golden visa” options.

Portugal has recently ended its golden visa for real estate investment (both direct or indirect) although other options remain for other types of investment.

It’s digital nomad visa/ temporary stay visa allows holders to settle for more than 90 days, up to one year.

And with one of the lowest costs of living among Europe’s popular digital nomad destinations (€986) a month for single people it’s an appealing option.

Honourable Mentions

Income Requirement: At least 2,857.50€/month

Cost of living (for a single person): €893

Average monthly salary after tax: €958

* Legislation is currently undergoing modifications before it can become official.

Income requirement: €3,000/month

Cost of living (for a single person): €1,694

Average monthly salary after tax: €3,163

Eligible non-EU digital nomads can apply for a residence permit and independent contractor visa to live and work remotely in Norway. Applicants must have at least one Norwegian client and are required to pay local taxes under the scheme.

Income requirement: €3,500/month

Cost of living (for a single person): €937

Average monthly salary after tax: €799

* Digital nomads are not permitted to work or freelance for Greek companies under the scheme.

Income requirement: €3,500/month

Cost of living (for a single person): €1,295

Average monthly salary after tax: €1,320

* Open to non-EU nationals, Cyprus's remote work visa has a cap of 500 visas.

Income requirement: €3,500/month

Cost of living (for a single person): €1,026

Average monthly salary after tax: €1,259

*Applicants must have health insurance, a clean criminal record and proof of income over €3,300 per month from a company outside of Romania.

Get In Touch

Enjoy our new features

Favorites

Save your favorite properties into your wishlist, get full access on all your devices.

Save my search

Save your search criteria into your account and go back to them anytime you want.

Email Alert

Create email alerts with all your desired features you wish, and receive emails with matching properties.