Modelo 720 – no longer a roadblock for expats

Modelo 720.

For over a decade, this declaration of overseas assets has been a sticking point for expats – putting them off a potential relocation, for fear of being hit with a hefty fine.

But the good news is – things have recently changed.

In light of a European Court of Justice ruling, certain aspects of the 720 form were found to be illegal. As a result, the Spanish Supreme Court has declared all previous fines null and void, and a new regime – with lower, more reasonable fines – has been introduced.

That means there’s no longer any reason to let this hold you back. Even if you have worldwide assets worth more than €50,000, if you wish to relocate and buy a property in Spain, you can now do so without the risk of a crippling penalty.

A new and improved penalty regime

Approved on October 29th 2012, Spain’s Modelo 720 was introduced to combat tax evasion, money laundering and the funding of terrorism. However, it was quickly criticised as being a ‘shameless attempt to shakedown expats’ and achieved nothing except scaring investors away.

The declaration of assets may be strictly informative, and no tax is charged upon filing of the form – but until now, failure to file or filing incorrectly resulted in extortionate fines. Fines which, in some cases, could equal (or even exceed!) the value of the assets themselves.

For most people, these stakes were simply too high. No matter how much they’d love to relocate, who would take the risk?

With this criticism in mind, in 2015, the European Court of Justice reviewed the legality of the Modelo 720 penalty regime. This review subsequently prompted an in-depth analysis, in which the Spanish Supreme Court ruled the penalties as being ‘disproportionate’ and a violation of EU laws, particularly with regard to the free movement of capital.

As such, past and present fines have been revoked – and are currently in the process of being refunded – and the penalty regime has been updated with immediate effect.

Welcome news for foreign residents and prospective investors alike.

What does this mean for future expats?

Only the penalty regime has changed.

If you meet the criteria of a Spanish resident for tax purposes, you may still be obliged to declare your worldwide assets, and therefore complete and submit the Modelo 720.

These worldwide assets can include:

- Accounts held within financial institutions (e.g. banks)

- Investments, such as stocks and bonds, financial rights, insurance, shares etc.

- Real estate and rights over real estate

If the value of your assets in one (or more) of these individual categories amounts to €50,000 or more, you will be legally required to file the 720 form. The only exception is if you previously submitted the form and none of your assets have grown by €20,000 or more since.

You still only need to declare assets located outside Spain, and the deadline of March 31st each year has remained exactly the same. But crucially, since the review, failure to declare your assets or errors in your submission will incur much smaller fines.

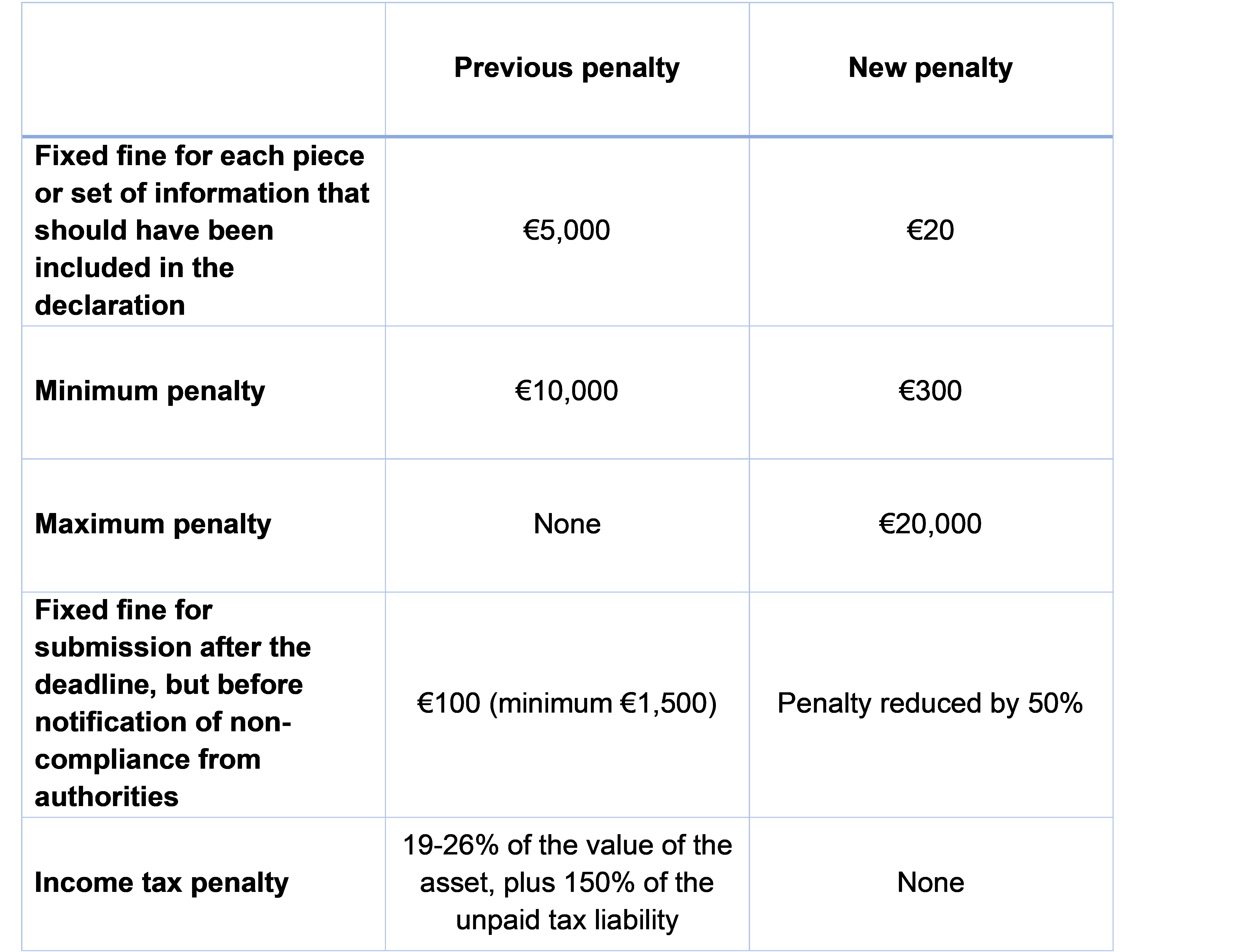

Modelo 720 is now subject to the general penalty scheme established in the Spanish General Tax Law. As such, the fines have been substantially reduced and are as follows:

To provide an example of how much lower the new penalties are: under the old regime, if a resident failed to declare a foreign bank account containing €50,000, the penalty would be around €25,000 (depending on the income tax rate). Going forward, the penalty will be just €300.

An ideal time to invest in Andalusian property?

For anyone interested in buying a property in Andalucía, this reduction in disproportionate Modelo 720 fines has certainly come at an ideal time.

Only a few months ago, wealth tax was abolished in this region, too.

Wealth tax was also regarded as an ‘unwelcome burden’ by investors; one which deterred many high earners from purchasing a home and moving permanently to the area. However, since September 2022, both residents and non-residents – with worldwide assets that fall above the €700,000 threshold – are no longer required to pay this.

More information on this change can be found in our previous blog.

Now that wealth tax has been eliminated, and there’s no risk of an exorbitant Modelo 720 fine, it’s believed that more than 7000 high earning tax contributors could be motivated to relocate. Are you one of them?

Contact our property specialists today

Perhaps this recent change to Spain’s Modelo 720 is the encouragement you need to finally make the leap and start searching for your dream property in Andalucía?

As a leading real estate agent, over the last 10 years, we’ve had many discussions with clients who have wished to relocate to the Costa del Sol – yet have been deterred by the Modelo 720 penalty regime and the impact of wealth tax.

These issues are no longer a cause for concern, making now a fantastic time to get in touch.

Here at Bromley Estates Marbella, we have a comprehensive portfolio of properties for sale in Andalucía, with something to suit all needs and preferences. Thanks to our extensive knowledge of the buying process – including associated costs, taxes and legal obligations such as the Modelo 720 – we can assist in finding your ideal home and ensure your relocation is as smooth as possible.

Simply give us a call on +34 952 939 460 (+44 208 068 7606) to get started.

If you have any questions about the recent changes to the Modelo 720 penalties – and how they could benefit you – please don’t hesitate to send an email to info@bromleyestatesmarbella.com. We’re always happy to help and will respond to your enquiry as soon as we can.